The following can be summarized about the factors affecting the development of gold prices:

- A weakening US dollar has a greater impact on raising the price of gold than rising interest rates

- Therefore, investors should not avoid investing in gold due to rising interest rates, as research indicates that rising interest rates do not always negatively affect the price development of gold

- US interest rate developments can strongly influence the price of gold in the short term

- However, the correlation between gold prices and interest rates is weakening

- Thus, the dollar better indicates the direction of gold price development

- There is no single factor that influences the development of gold prices

- Investors typically focus on two things: the US dollar and interest rates

This is summarized by the World Gold Council in its research, reported by GoldCore*.

About the relationship between the euro and the dollar

Market analysts agree that the dollar has a greater impact on the price of gold than interest rates.

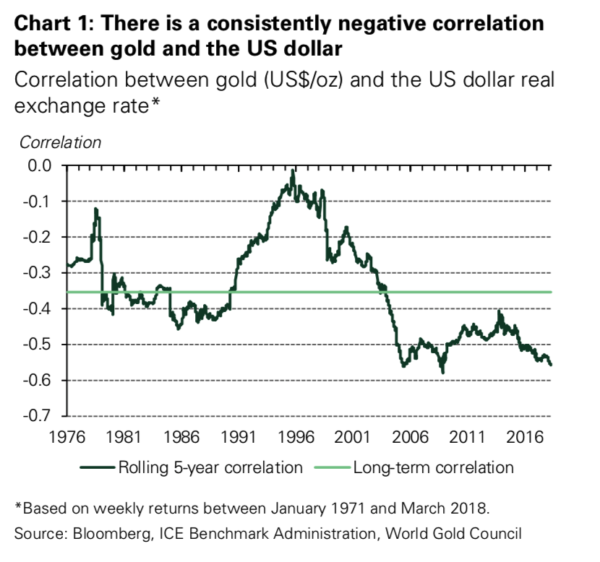

This is understandable, as there has been a continuous negative correlation between the price of gold and the dollar.

This relationship is also clarified by the image below.

There is thus an 'asymmetric correlation' between the price of gold and the US dollar. Why is this?

Not all gold is purchased with US dollars – local currency flows also affect demand.

Therefore, gold is best understood as a broad fiat currency hedge rather than just a hedge against the dollar. This is particularly emphasized during times when major currencies weaken and investors buy gold to protect themselves from this risk – such as during the debt crisis of European countries.

In such cases, gold and the dollar tend to move in the same direction, which further explains why uncertain times, due to increasing geopolitical risk, are likely to raise the price of gold. Even if the dollar strengthens, for example, in the context of the Syrian conflict, the price of gold can still be seen to rise.

About the relationship between use and interest rates

Recently, the price of gold has reacted positively (+8.5%) to the U.S. Federal Reserve's decision to raise interest rates since last December.

Can we conclude from this that the U.S. interest rate is actually a more important influencing factor? According to the WGC's research, there is no clear answer to this, as there are exceptions.

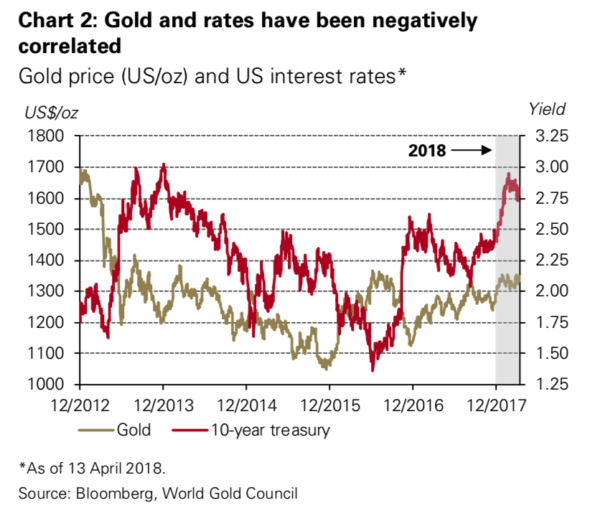

There is a negative correlation between gold and interest rates, and especially between 2013 and 2017, the correlation has been strong:

It would therefore be too easy to draw a quick conclusion that changes in U.S. interest rates begin to affect the price of gold.

However, there are also other factors in the market, such as the demand for precious metals in the jewelry industry and technology – does the U.S. interest rate affect these as well? Probably not.

The WGC report states in a dual manner and advises to approach these findings with some caution:

"Falling interest rates are generally associated with higher gold prices; however, rising interest rates do not always correlate with lower gold prices."

Four impactful factors

The WGC lists four broader areas whose relationships affect the price of gold:

- Wealth and economic development: growth periods support the jewelry industry, technological development, and long-term savings

- Market risk and uncertainty: a market downturn often increases the demand for gold as a safe haven

- Competing opportunities: bonds (interest rate effect), the impact of currencies and other assets on investors' attitudes towards gold

- Opportunity and positioning: cash flows and price trends can reinforce or dampen gold price development

*Source article and images for the summary (except main image): GoldCore, Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates (April 26, 2018)

Read WGC's original research (EN)