Anna Golubova wrote an intresting article regarding the annual In Gold We Trust Report published by Incrementum AG.

The yellow metal could be looking at nearing the 140€ an gram price tag in a decade and that is a conservative estimate, according to the annual In Gold We Trust Report published by Incrementum AG.

The 14th annual report made some pretty bold predictions for the gold market, forecasting prices to, at least, approach 140€ an gram and possibly even push towards 260€ an gram by 2030, Incrementum AG fund managers and authors of the report Ronald-Peter Stoeferle and Mark Valek wrote on Wednesday.

The difference wherher it will be near 140€ or 260€ per gram will depend on the global dept sitsutaion and inflation.

“The proprietary valuation model shows a gold price of 140€ at the end of this decade, even with conservative calibration. Should money supply growth develop in a similar inflationary manner to that of the 1970s, a gold price of 260€ is conceivable by 2030,” the report stated.The monetary systems in their current form all have an expiration date, the authors of the report said. “Due to the expected economic and monetary turbulences, the coming years will hold many challenges for investors,” Stoeferle and Valek wrote.

In the short term, prices may surprisingly drop if there is too much optimism in the market regarding gold. Given the current market sensitivity, seasonality, and the CoT report, we would not be surprised to see a few weeks of consolidation, wrote Stoeferle and Valek.

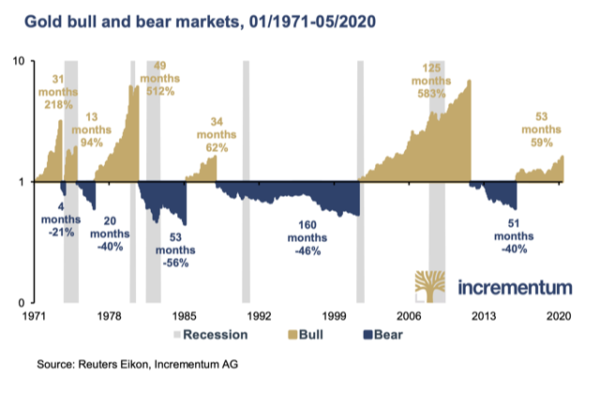

In the long run, the report sees new peaks that are just a matter of time. The question is not whether the price of gold in dollars will reach new highs, but how high it will go. The authors are confident that gold is a proven productive investment over this decade and brings stability and security to every investment portfolio.

According to the report's authors, the COVID-19 outbreak changed the market situation by accelerating an already inevitable recession. The coronavirus was then just a feather that broke the economy's backbone. We are currently experiencing the strongest economic contraction in 90 years. Debt-driven expansion in the United States has slowed since the end of 2018, and gold analysts had already warned of darkening recession clouds last year. Measured in gold, the U.S. capital market peaked over 18 months ago. COVID-19 and the response to it acted as a massive accelerator for this, the report stated.

Incrementum AG has ruled out a V-shaped recovery as the economy reopens around the world.

Another major driver of gold prices is the failure of monetary policy normalization, which has serious implications for inflation and debt management.

Central banks are struggling to combat the upcoming inflation

The report states that there is a consensus among governments and central banks on how to combat the consequences of the COVID-19 crisis: as many people as possible should be saved at any cost... Debt is spiraling out of control, the report said. After the coronavirus, the world faces a global debt crisis.

"Debt is unlikely to be financed anymore, as global savings are no longer sufficient to cover the financing needs that are essential for maintaining the operation of the electronic printing press."

According to the report, inflation problems are also beginning to emerge, and inflation is seen as the "dominant investment theme" in the coming years. "Central banks are struggling to combat future inflation. Inflation arising from over-indebtedness cannot be countered with significant interest rate hikes," Stoeferle and Valek said.

Longer-term, the report sees new all-time highs for gold as just a matter of time. “The question is not whether the gold price will reach a new all-time high, but how high this will be. The authors are convinced that gold will prove to be a profitable investment over the course of this decade and will provide stability and security in any portfolio,” the report said.

The COVID-19 outbreak has changed the market landscape quickly by accelerating an overdue recession, according to the report. “There is unanimity among governments and central banks on how to combat the economic consequences of the Covid-19 crisis: As many people as possible should be saved, whatever the cost … The debt is now threatening to get out of hand for good,” the report said.

To read the original article: