This is Jalonomi's weekly review of the most interesting precious metal news from various sources around the world. Our goal is to provide readers with a concise and quick access to the news on a weekly basis. We particularly focus on news related to investment gold.

This week in our review:

- The Conversation Trust: Why Gold Still Acts as a Safe Haven in Times of Crisis

- Degussa Market Report: The Threat of Inflation and the Case for Gold

- Gold Eagle: The long-term price forecast is upward

- Business Standard: The price of gold should be $5500 per ounce relative to available income

- The Coin News: The production of precious metal coins in the USA is on a sharp rise

The Conversation Trust: Why Gold Still Acts as a Safe Haven in Times of Crisis

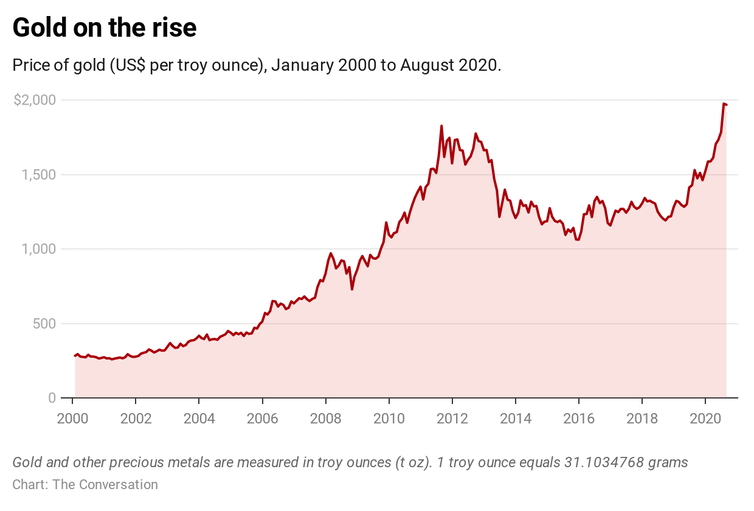

The interest in gold has accelerated during the coronavirus pandemic, pushing the price of gold to a historic high, surpassing the previous record set in August 2011. Even Warren Buffet, despite his earlier dismissive comments about gold, has acquired gold mining stocks for his portfolio. However, owning gold stocks is not the same as owning actual gold: gold stocks tend to move with the broader market, especially during price declines. They do not have the safe-haven characteristic. A safe haven retains its value during extreme, unpredictable events. This can be seen in the price development of gold over the past two decades:

Gold is a safe haven because it has historically served that purpose. Relying on past experiences, people believe in gold's safe haven properties, and it functions as such due to this trust. Gold has been regarded as a store of value since ancient times. Gold is beautiful, malleable, durable, and rare. The extraction of additional gold has never diminished its value. Gold, silver, palladium, and platinum are all precious metals, but only gold is a safe haven. Other metals have played different roles in the world of money and investment. Gold is a safe haven also because it is simple, well-known, and the first thing that comes to mind when investors face extreme uncertainty.

Readfull articleenglanniksi / 13.9.2020, Dirk Baur, Professor of Finance, University of Western Australia & Allan Trench Professor, University of Western Australia

Degussa Market Report: Inflation Threat and the Case of Gold

Economist John Maynard Keynes (1888-1946) once supported the idea that the only way to destroy capitalism is to destroy its currency. The destruction of currency is a slow-progressing and hard-to-diagnose disease. According to the report's citation, printing money is the worst possible compulsory loan and particularly affects workers and the poorest in society, being the greatest evil of economic disorder.

In this context, the report mentions the latest change in the US Fed's inflation target in August 2020 – an average inflation target of 2%. The reason for this target is apparently clear according to the report: by the end of August 2020, the amount of M1 money in the US had increased by 40% compared to the previous year, and M2 money by 23%. The growing amount of money will sooner or later affect the rise in consumer prices.

As long as central banks continue in an inflationary direction, a sensible investor has good reason to consider holding gold as part of their liquid assets, since the increase in the amount of currency by central banks does not diminish gold's purchasing power. And unlike bank deposits, gold does not carry payment leverage risk. At current prices, gold offers an attractive risk-reward profile, with significant potential for price appreciation and only a minimal risk of price decline.

Readfull reportenglanniksi / 10.9.2020, Degussa Marketreport

Gold Eagle: The Medium-Term Rising Price Forecast Remains

Gold Eagle follows medium-term forecasts for gold, particularly price developments over a four-year period. Recent corrections seen in both the gold and stock markets in the USA are viewed as counter-trend corrections within broader upward trends. If the assumption is correct, gold may see the next good upward movement that drives the price towards $2200 per ounce or even higher.

Readfull articleenglanniksi / 13.9.2020, Jim Curry

Business Standard: The Price of Gold Should Be $5500 per Ounce Relative to Available Per Capita Income

Jefferies' CEO Christopher Wood is increasingly confident in the gold bull market and expects the price of the yellow metal to reach $5500 per ounce – a rise of over 180% from the current price and a 31% increase from his earlier forecast of $4200 per ounce this year.

The previous price forecast was based on the price of gold in relation to the per capita income invested in available gold in the USA when the price of the yellow metal reached its then peak of $850 during the previous secular bull market in January 1980.

“The price of gold at that time was 9.9% of the available per capita income, which was $8547. The current price of gold is $1952 or 3.6% of the available per capita income of $53747. To achieve 9.9% of the available per capita income, the price of gold would need to rise to $5345. This means that $5500 is a reasonable peak price target for the current secular bull market,” he claims.

Readfull articleenglanniksi / Chris Wood Jefferies, 21.8.2020

The Coin News: Production of Precious Metal Coins is on the Rise in the USA

The production of coins in the USA has surged for the third consecutive month, according to production figures from the United States Mint. US Mint facilities struck over 1.65 billion coins into circulation in August, marking the second-highest monthly output for the mint since July, starting from January 2017. The amount increased by 116% compared to the same period last year.

Readfull articleenglanniksi / 11.9.2020, Mike Unser