This is Jalonomi's weekly review of interesting precious metal news from various sources around the world. Our goal is to provide the reader with a concise and quick-to-read overview of the news on a weekly basis. We particularly focus on news related to investment gold.

This week in our review:

- Use mysterious origin

- Use of development prospects until 2021

- Gold bars next to a toilet paper package in the shopping cart

- The USA elections reflect the near-term outlook for gold

Energy and Capital: How Gold is Created in the Universe

It has been fought over. It has been chased and died for. This is how Energy and Capital writes about the coveted yellow metal and seeks answers to the fundamental question that still lacks a response: how does gold form, where does it come from?

Astronomers believed for decades that gold is formed in supernova explosions – when massive stars collapse and release immense amounts of energy, writes Energy and Capital. Supernovae can shine 10 billion times more brightly than our own sun. This theory was dismissed about 10 years ago, as it is known that massive supernovae form black holes. Later, a new theory attempted to explain the creation of gold from a kilonova collision, where two or one neutron stars collide with a black hole. However, a recent English study shows this theory to be incorrect as well: these collisions are too rare to produce the amounts of gold that exist in the universe.

Astronomer and research director Chiaki Kobayashi says:

“Neutron star mergers are not enough, and even if there were another source, they would not be sufficient to explain the amount of gold known to exist.”

So where does all the gold come from? The Population Reference Bureau estimates that over 100 billion people have walked the Earth, most of whom have been aware of the existence of gold in some way. None of them have yet been able to provide an answer to how the universe creates gold or where it comes from. According to the author, we must currently settle for this:

Readfull article in English/ 5.10.2020, Luke Burgess

Sbma: Will the Gold Price Rally Continue

SBMA (Singapore Bullion Market) expects the gold market to continue strengthening into 2021 and states that its own scenario is 13-50% higher than general price estimates. Influencing factors, in their opinion, include a change in consumer behavior towards safe havens, as well as risks related to the global economy, geopolitics, and the pandemic.

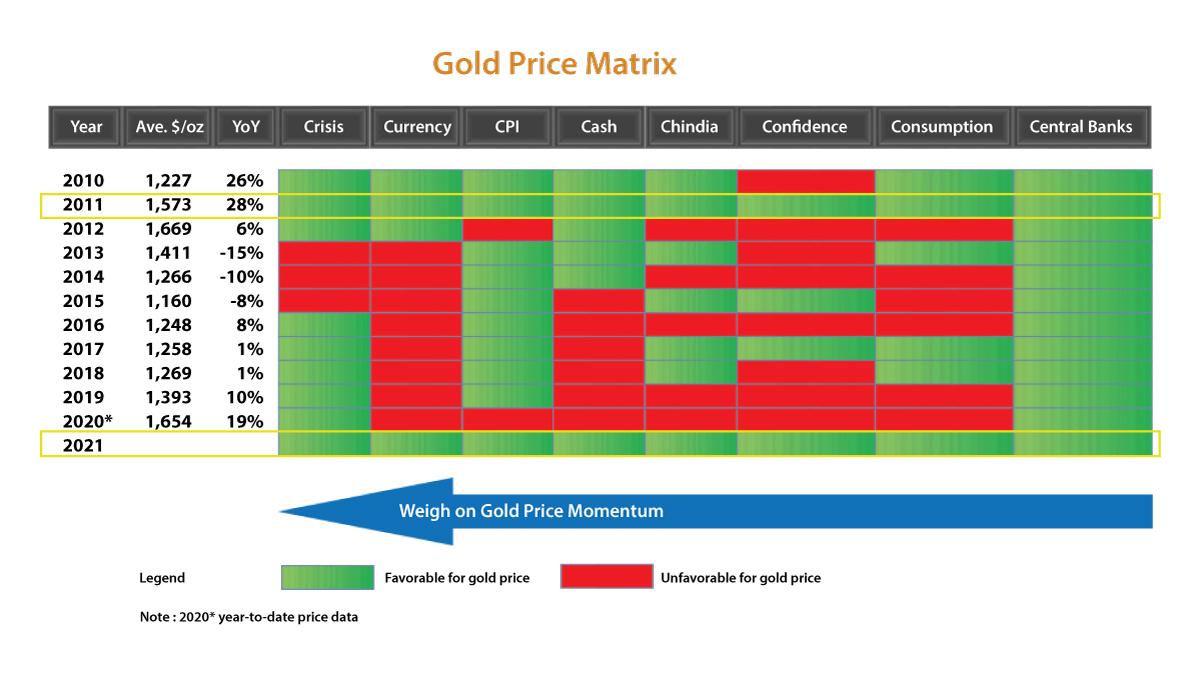

According to SBMA, consumers' adjustment to higher gold prices and increased investment demand are creating upward pressure on the price of precious metals in 2021. Consumers and industries may start hoarding gold, particularly in India and China. Market sentiment regarding gold is likely to strengthen as the dollar fluctuates. Central banks and investors are seeking gold as a portfolio diversifier and a hedge against inflation.

All of these create sunnier prospects for gold as a safe haven for personal finances. SBMA also presents the gold price matrix, whose eight factors appeared favorable for gold in 2021:

Figure 1: SBMA's gold price matrix

Readarticle in English/ Eily Ong, Global Analyst, Bloomberg Intelligence

Dailymail: Costco Starts Selling Gold Bars

American wholesale retailer Costco is set to start selling gold in its supermarkets, according to Dailymail. Gold bars are not a typical item on a shopping list, and the paper warns shoppers about the risks: the price of gold fluctuates significantly, which, along with high profit margins, can lead to bad deals. According to Dailymail, the price of gold has risen by 28% over the past 12 months. Silver bars are also being sold at astonishing premiums.

Gold is more commonly purchased directly from bullion dealers rather than loaded into shopping carts alongside toilet paper, writes the Dailymail. Investors are also buying funds tied to physical gold. The Dailymail reports that market analysts are predicting a rising gold price for the coming year.

Readarticle in English/ 4.10.2020, Dan Atkinson

Heraeus Precious Metals: Gold on the Brink of Elections

The 2020 American presidential election will be unprecedented, writes Heraeus in its report. The recent debate did not calm the market's uncertainty. The coronavirus infection of the U.S. presidential couple a month before the election worries investors. Polls show Biden with a clear lead, but Heraeus reminds us that surprises may be in store, as in previous elections. Biden's campaign promise to raise the corporate tax from 21% to 28% could shift investors' interest away from Wall Street towards safe havens like gold and bonds. Biden also suggests continuing borrowing in the coming decade. If this leads to a weaker dollar, the situation is favorable for gold, according to Heraeus. Therefore, the U.S. elections are a vote for gold.

Regardless of the November election results, Heraeus predicts that the weak macroeconomic situation will continue in the USA, which supports gold. With no vaccine in sight and the country's economic recovery appearing fragile, there is demand for gold's safe-haven properties. Political and economic uncertainty is already reflected in the price of gold, but this trend may intensify as the elections approach, increasing the allure of gold as a safe haven.

Readarticle in English/ 5.10.2020