- Yahoo! Finance: Gold remained stable throughout the pandemic

- Reuters: The new year for silver is strong

- Sharps Pixley: Lawrie predicts a bullish new year for precious metals

- Goldmoney: A gold-backed currency to replace the fiat monetary system?

Image: Yahoo! Finance

Yahoo! Finance: Gold remained stable throughout the pandemic

2020 is the golden year of this decade, writes Kumutha Ramanathan of Yahoo! Finance. The dollar reached its lowest level since April 2018, while the value of gold bars only increased. It hit a record of €1,625 in August as U.S. interest rates collapsed and investors sought alternatives to their stocks.

Analysts are divided on how the price of gold will develop in 2021. According to Morgan Stanley, the pressure on precious metals will increase as economic markets stabilize, while HSBC believes the value of bars will continue to rise. UK Capital Economics' estimate falls in between: they believe commodity prices will remain around €1,545 per ounce throughout 2021. They warn that the forecast carries risks. For example, they assume U.S. interest rates will remain near zero until 2023, but the economy could recover faster than expected. Investors may also continue to rely on safe-haven assets. However, they believe that investment demand will remain high for the time being.

Read the full article in English / 31.12.2020, Kumutha Ramanathan

Reuters: The new year for silver is strong

Reuters' Peter Hobson writes that last year was favorable for precious metals and 2021 promises further growth for them, especially silver. The value of precious metals, particularly gold and silver, skyrocketed during 2020 due to the pandemic's impact on the global economy and as investors began to favor traditional safe-haven assets to protect their wealth. As a result, gold rose over 20% and silver 47%.

According to Metals Focus consultant Philip Newman, gold and palladium will reach record highs in 2021, but silver will rise even more. We saw how physical gold demand suffered last year, but its investment demand grew: for example, the annual profit of the SPDR Gold Trust was 30% - the largest since 2009. When the Covid-19 vaccine was rolled out, prices fell and investors began to favor assets that thrive in economic growth.

Independent analyst Ross Norman, however, believes that massive government debt, negative real yields on securities, and inflation risk will support gold in 2021 as well. He suggests that the value of gold could rise another 20%. Silver may perform even better as the economy recovers, as it is an industrial metal used in solar panels, and U.S. President-elect Joe Biden is believed to favor clean energy.

Read the full article in English / 31.12.2020, Peter Hobson

Sharps Pixley: Lawrie predicts a bullish new year for precious metals

Sharps Pixley's Lawrence Williams reflects on the past year: In January 2020, gold's value was forecasted to rise a modest 10%, but then the coronavirus appeared and pushed the value up 36% by August. This was followed by a sharp correction, but by the end of the year, gold's value had still increased by as much as 22%.

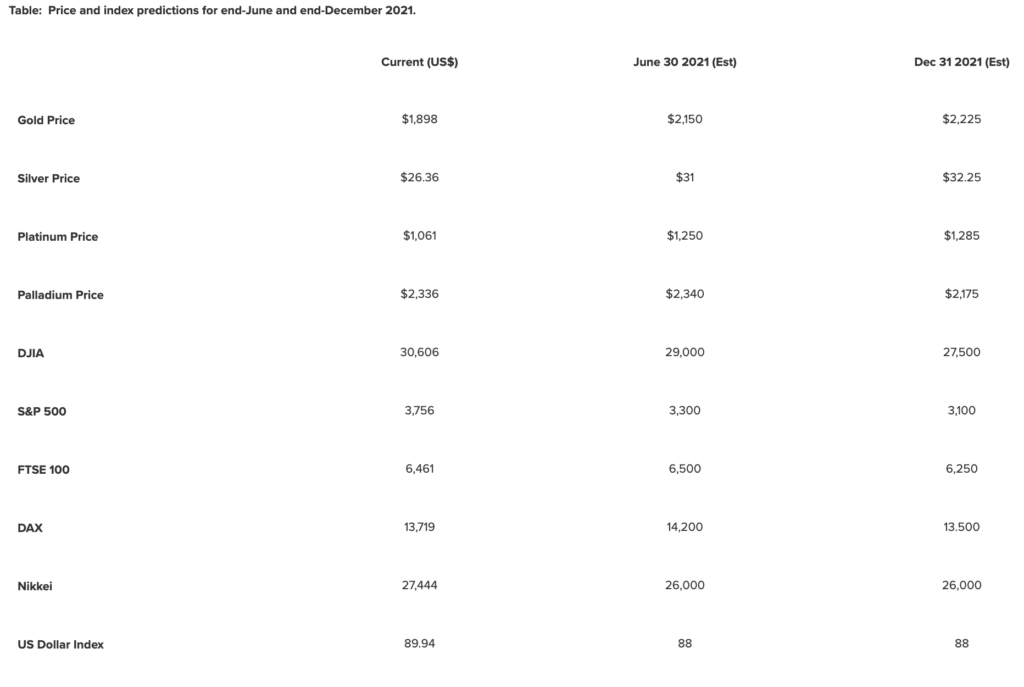

He believes that regardless of vaccine news, the pandemic will continue to shake the world in the first half of 2021 and will only be brought under control in the latter half of the year. This means the global economy will worsen further before it begins to improve. His prediction is based on a new, more contagious strain of the virus and the fact that, despite the rollout of the vaccine, infection rates are on the rise. Sharps Pixley firmly believes that both gold and silver prices will rise significantly in 2021, while the stock markets will suffer slightly. Lawrence notes that if the worst fears regarding the spread of the virus and its economic impacts come true, their predictions may even be considered moderate.

Sharps Pixley's precious metal price forecasts for 2021 are compiled in this table:

Read the full article in English / 1.1.2021, Lawrence Williams

Goldmoney: A currency based on gold as a replacement for the current monetary system?

Goldmoney'sAlasdair Macleodwrites that fiat money will soon lose its value one way or another, as hyperinflation and economic instability turn citizens against it and Keynesian ideology. Two notable candidates have been proposed as replacements: currencies based on gold and silver or cryptocurrencies. In this comprehensive article, Alasdair argues why the current monetary system must be replaced and why it will be replaced by gold.

He presents several arguments for why a fiat currency-based economy cannot endure and why it will eventually collapse. Key reasons include the hyperinflation of the dollar that began in the second half of 2020 and the predicted collapse of the dollar's value in exchanges outside the United States. So far, the U.S. Federal Reserve has tried to prevent this by devaluing the dollar, but this can only continue as long as the public allows.

According to Macleod, the collapse of the system will first be noticed in the stock exchanges of other countries, after which the U.S. government will fall into a debt trap and bankruptcy - unless it makes significant spending cuts. This will be followed by a period of economic instability and the end of fiat currencies.

It is generally believed, according to the article, that the state will take control of the economy's reset and transition to, for example, central bank cryptocurrencies. But citizens are unlikely to accept this. The reset completely ignores the core of the problem: currency cannot be trusted to the state. A gold-backed currency is the only viable solution, as central banks and funds own significant amounts of gold. They will introduce a substitute currency that can be exchanged for gold coins at a predetermined price. In other words, we are returning to the currency system that existed before World War I. Presumably, China and Russia will be the first countries to transition to a gold-backed currency.

Read the full article in English / 12/23/2020, Alasdair Macleod

This is Jalonom's weekly review of interesting precious metal news from various sources around the world. Our goal is to provide the reader with a concise and quick-to-read overview of the news weekly. We particularly focus on news related to investment gold.