Silver, bars, and coins offer clear advantages to investors. Although silver is subject to value-added tax, it makes the investor stronger. Like investment gold, investment silver is an essential part of a strong investment portfolio.

1. Silver is money

Silver is not one of the currencies in use, but it is still money. In fact, silver, like gold, is real money because it cannot be created from nothing like paper or digital documents. And referring to real money, it means physical silver, not ETFs or promises of silver. They are paper investments and do not have the same advantages as physical silver.

The value of silver fluctuates, but its value is timeless.

Silver has no counterparty risk; you do not need contracts, brokers, or other parties to own it.

2. Silver is tangible property

You can hold silver in your hand and put it in your pocket. It cannot be destroyed by burning, water, or time; it is and remains. It cannot be hacked or removed, unlike savings accounts, bank accounts, and payment services like credit cards. You can take it with you anywhere, and it can be as private an investment as you want. Silver is very easily convertible to cash, meaning it is liquid. Selling it is often faster than selling stocks from your brokerage account.

3. Silver is cheap

What if you could get the benefits of investment gold at a significantly lower price?

Silver, despite the value-added tax, is significantly cheaper than gold and offers the same benefits to its investor. In Finland, silver is not classified as an investment product and is therefore subject to value-added tax.

4. Silver is practical

Silver is practical not only because of its low price but also when it comes to selling. The need for cash can sometimes be smaller, and you don't want to sell a one-ounce gold bar; silver is often valued in smaller pieces, making it practical in everyday life.

5. Silver outperforms gold in a bull market

The silver market is very small, so small that even a small amount of money coming into or leaving the industry can significantly affect the price more than in other investment assets (including gold). This greater volatility means that in bear markets, silver drops more than gold. But in bull markets, silver rises much longer and faster than gold.

| Rise from 1970 to 1980 | Rise from 2008 to 2011 | |

| Gold | 2.328% | 166% |

| Silver | 3.105% | 448% |

We can expect this yield difference to repeat in the next bull market as the silver industry is still very small.

6. Silver investors are declining

Governments and other institutions have traditionally held silver reserves. But nowadays, most governments no longer hold metal reserves. The only countries that stockpile silver are the United States, India, and Mexico.

One reason why governments no longer own silver is that money is no longer made from precious metals. Instead of coins, silver is now used much more in industry, and if the demand for silver used in industry grows in the future, governments will be poorly equipped to support these needs.

7. Industrial demand is growing

Silver is used in almost all industries, from electronics to medicine and from batteries to solar panels. Silver is everywhere.

As Mike Maloney said in his book, 'Of all the elements, silver is the essential metal. It is the best conductor of electricity, heat, and is reflective. Modern life would not exist without silver.' In fact, industry now accounts for over half of silver demand.

There are countless examples of silver's industrial applications. However, due to its unique properties, the industrial uses of silver continue to grow. Unlike gold, most industrial silver is consumed or destroyed during the manufacturing process. This limits the supply of silver that could return to the market as recycled.

8. Supply is declining

Since 2011, after silver prices peaked, they have dropped by 72.1% over the next five years. The search and development of new silver mines has been cut back. And the less time and money spent searching for silver, the less is found. This is starting to show in the supply of silver.

Silver supply has declined for the first time in three consecutive years, after 1991-1993.

Even two-thirds of silver mine supply is base metals, by-products (such as copper and zinc). If silver demand remains at current levels, it will be difficult for anyone wanting silver to obtain as much as they need.

9. Demand is growing globally

All major government mints have seen record sales. The increase in demand is nowhere more evident than in China and India. These two market giants have long historical and cultural ties to precious metals. And as their populations grow, so does the demand.

Sooner or later, when high demand meets wavering supply, there will be consequences. And these consequences will be positive for those who own silver.

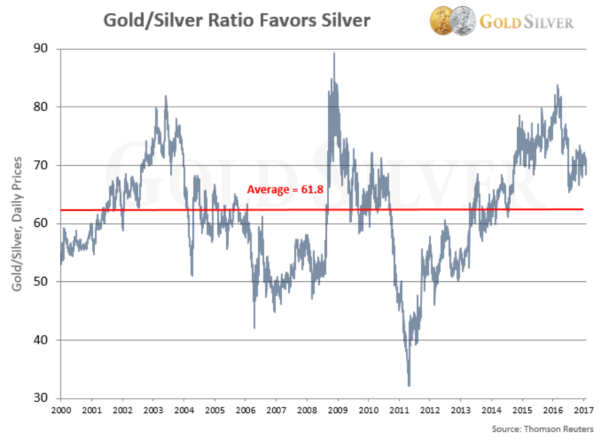

10. The gold-silver ratio favors silver

The gold-silver ratio (the price of gold divided by the price of silver) can provide hints as to which metal would be a better investment, especially when the ratio reaches extremes.

The gold-silver ratio averaged 47:1 in the 1920s. In the 2000s, it has averaged around 61:1.

So when the ratio is 70 or higher, silver is a good buy relative to gold. This ratio indicates how much the price of silver can rise relative to gold and how undervalued the investment in silver is.

It is hard to find an investment with a greater distortion between price and fundamentals. It is not only a good hedge against crises, but the price inevitably rises as fundamentals are stormy.

You can find the original article here: https://goldsilver.com/blog/top-10-reasons-to-buy-silver/