Why buy gold? 10 reasons to invest in physical gold

Is gold a good investment? Why buy gold in bars or coins?

Investment gold, bars, and coins offer clear advantages to investors that are not found in other investment assets. Although gold is just a solid piece of metal that does not earn interest, it makes the investor stronger.

Owning physical gold is an essential part of a strong investment portfolio. Most of the risks of investment gold come from investing in promises, in other words, gold that is under external control. These promises are not like ones and zeros on a computer screen, which are not much different from banknotes.

1. Gold is money

The value and significance of gold as money have been known since ancient times. It has been money longer than any other currency in history, for at least 3000 years. One of the most important promises of money is that it retains purchasing power. Unlike any other currency, gold fulfills this promise.

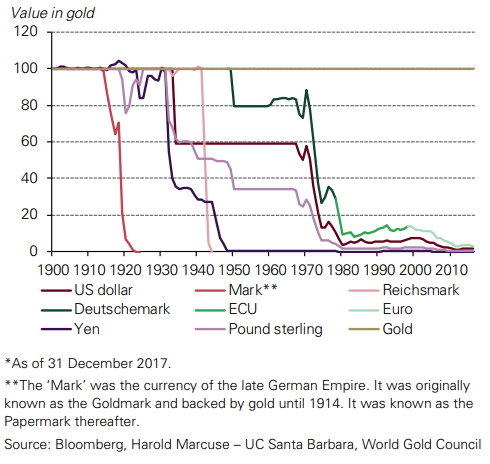

Below is a visualization of the change in purchasing power of the largest countries' currencies compared to gold.

From this, we see that since 1900, physical gold is the only asset that has retained its value. There have been times when other currencies temporarily rose above gold, but in the long run, gold has maintained its value.

The price of gold fluctuates, but its value is timeless. Think about how gold would preserve the purchasing power of your savings, for example, over the next five years, compared to the current currency. All paper currency loses value over time due to its nature. Whether your savings are in cash or in a savings account at a bank, their purchasing power will inevitably decrease in the long run.

Physical gold is one of the most ideal forms of preserving long-term wealth. It is also ideal for heirs, as it remains and is always valid for exchange for something else.

2. Gold is a tangible asset

If you take physical gold, you can hold it in your hand and put it in your pocket. This is something you cannot do with many investment assets. Pure gold cannot be destroyed by burning, water, or even time; it is and remains. It does not need to be fed, fertilized, or maintained. And because the amount of gold is limited, it has an intrinsic value that other commodities do not have.

Production vs. Storage: The Misunderstanding of Gold

Those who criticize gold for its inability to earn interest misunderstand its role in a portfolio. The purpose of gold is not to generate income; its purpose is to serve as money and a store of value. For this reason, gold should not be viewed merely as another commodity, as it cannot be consumed like oil or corn. All mined gold reserves are still here, in one form or another.

Another advantage of gold being a tangible asset is that it cannot be hacked or removed. Unlike savings accounts, bank accounts, and payment services like credit cards, gold bars are beyond the reach of hacking and identity theft. Even if the ones and zeros that make up your bank account disappear into nothingness or your cash is destroyed in a laundry, the gold bar you own is safe.

In today's world, it is probably good that part of your wealth is outside of digital form. If internet access is unavailable or computers and online environments crash, they do not affect a physical gold bar or coin. In fact, they could be a lifesaver in that situation.

3. Gold has no counterparty risk

To own physical gold, you do not need papers, a broker, contracts, or other parties. This is because gold is the only financial asset that is not under the responsibility of any company or community.

This is important because gold will be the ‘last man standing’ during bubbles bursting and crises. Gold is a very strong tool in an investment portfolio when things start to go wrong in your country or your own finances.

It also means that the price of gold will not drop to zero. This has never happened in over 3000 years of history. This is a strong feature of gold, especially when asked by former shareholders of companies.

Gold always has value. And it can always be exchanged for another currency, now and in the future.

4. Investment gold can be confidential and private

How many things can you say this about today? If you want a bit of privacy, physical gold is one of the few assets that offers such an advantage.

Gold is one of the few investment assets that can be owned anonymously. If you want, no one has to know about it. Practically no other investment you make offers such an advantage.

Please note that despite all this, the investor has an obligation to report their earned capital income to the tax authorities as required by law.

5. Gold is liquid and portable

Gold is always easy to sell and can be carried with you wherever you go. Gold is very easily convertible to cash, meaning it is liquid. Practically any precious metals dealer will recognize your gold bars and will be willing to pay for them. You can sell it to a local jeweler, a pawn shop, a private individual, or online. It can always be exchanged for cash!

Selling gold is often a quicker process than selling stocks from your brokerage account. First, there is the order processing, which can take up to three business days, after which the money can be transferred to your bank account. Other collectibles, such as artworks, may take longer to sell due to a smaller customer base. But gold can be exchanged for cash or other commodities right on the spot, effortlessly.

Liquidity means you can take gold with you wherever you go, and it can be exchanged for cash anywhere! And if traveling abroad with investment gold doesn't feel natural, you can buy gold in various forms such as jewelry.

6. Gold is easy to store and has low maintenance and upkeep costs.

One question regarding physical gold is its storage. Where is it best to store it? How much does storage cost?

Although professional storage comes at a cost, vault prices are generally reasonable. The cost of a vault can be compared to other investments, such as real estate. You can lock gold away from others until you need it, without late rent payers, maintenance requests, or complicated tax issues.

You can also, of course, store investment gold at home, hidden or in a safe. Keep in mind that gold packs a lot of value into a small space; you can hold a gold bar worth $50,000 in your palm. And with the price of gold being over $1,200 an ounce, you can store more value in gold than in cash in a safe.

7. Gold does not require special expertise or knowledge.

Can you identify a real diamond? Can you tell which of two paintings is the authentic Van Gogh? Which stamps, baseball cards, or antique furniture are more valuable than others?

A gold bar requires nothing. You don't need special expertise, training, or equipment to buy one.

You can buy rare gold coins, but this is a collector's world. As an investor, you are not looking for a coin with numismatic value hoping to get more than you paid for; rather, you invest in gold to gain security during crises, from the vanishing purchasing power of other currencies, and to avoid investing in promises. Rare coins are not needed for this.

8. Gold can protect against bad politics

You don't have to believe in conspiracy theories to know and understand that governments sometimes go too far. They can freeze bank accounts, regulate wages, and even confiscate assets. You can ask someone who has been subjected to such actions; they can tell you if they were warned in advance.

In economic and financial crises, these actions increase. The government desperately needs revenue, and obtaining it and enforcing actions are usually more aggressive. Or they simply adjust taxes, laws, and regulations to suit their own needs. This has actually happened in all countries and will happen again, especially during crises.

There are only a few ways to protect yourself from such actions. One of these ways is to hold physical gold abroad.

Diversifying assets internationally sounds complicated, but nowadays it is not difficult. It is as easy as opening a bank account. By doing this, you buy yourself time in the event of a crisis. Even if you never need to use these contingency funds, they act like insurance against aggressive and unjust political actions. You can even use the proceeds from selling these investments for other investment opportunities.

It is a good idea to keep part of your assets outside the banking system and political influence. A professional safe deposit storage provides a simple way to do just that. It is not a miracle cure, but it can create a so-called layer between your assets and heavy bureaucratic actions.

And the idea is that these preparations must be in place before anything happens.

9. Gold protects the stock market

Do you want to protect the stocks you own? Are you worried that the stock market might crash?

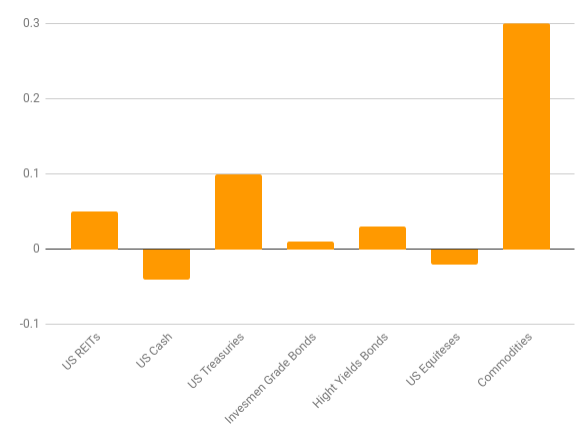

Gold might be the right solution for you. The chart below shows the correlation of gold compared to other asset classes since 1975. The zero line means that gold does the opposite half the time. If it is below zero, it moves in the opposite direction more often than the investment does (and vice versa if it is above zero).

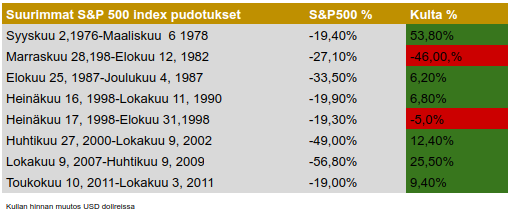

This shows that on average, when the stock market declines, gold rises and has risen more than it has fallen throughout its history. This inverse correlation is also true when the stock market has crashed. See how gold behaved during the eight largest stock market crashes since 1975.

Gold's return/loss during stock market crashes

This shows us that in most cases, gold rose when the S&P fell. (The only significant drop in gold, -46% in the early 1980s, occurred just after the largest rise in gold's history.) It is true that the price of gold initially fell due to the 2008 financial crisis. But as the S&P continued to decline, gold sharply reversed and ended the year up 5.5%. During the 18-month stock market sell-off, gold rose over 25%. Gold does not automatically rise with every stock market decline, but history shows that gold is sought as a safe haven when other markets collapse.

10. Gold protects your investment portfolio during crises

One of gold's strongest advantages is that it can protect your investments, even your standard of living, during economic, monetary, or geopolitical crises. Depending on the nature of the crisis, gold can shift from a protective tool to a productive asset.

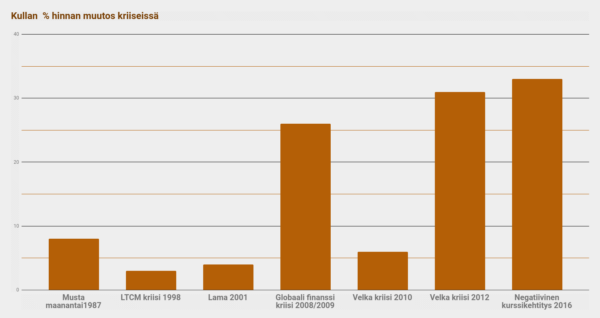

Below you can see how the price of gold has reacted to various crises.

When a crisis begins and fear grows, whether the investor is concerned about the stock market or more comprehensive events affecting everyone's livelihood, gold is a natural safe haven. Fear is what causes panic/crisis in people, so the greater the concern, the more people turn to gold, and the higher the price of gold rises.

Much could be written about the various crises that are possible today, but it is important to know that the risk levels of economic, tax, and monetary systems have risen. There are so many risks that the price of gold is expected to reach an all-time high as crises escalate.

Here is the potential of gold: the second half of the 1970s was more difficult. It included an interest rate of over 15 percent, high unemployment, 14 percent inflation, an energy crisis that included an oil crisis, the Soviet invasion of Afghanistan, Cold War tensions, and recessions at both the beginning and the end of that period. How did gold react to this?

From August 1976 to January 1980, the price of gold rose by 721 percent!

Gold is often about protection, but in addition to its strength, gold offers a tremendous return potential, considering the uncertainty of today's economy and monetary systems. The main reason for this is the increasing supply of fiat currencies and mortgage debts around the world. This indicates that the decline could be significantly larger than usual, and the greater the decline, the greater the rise in the price of gold.

How many other investment assets have all these advantages?

| 1 | Gold is money | Physical gold is one of the most ideal forms of preserving long-term wealth. It is also ideal for heirs, as it remains and is always valid for exchange for something else. |

| 2 | Gold is a tangible asset | Physical gold cannot be hacked or removed. |

| 3 | Gold has no counterparty risk | Physical gold cannot go bankrupt. It is not affected by contracts or obligations. |

| 4 | Gold can be confidential and private | Gold is one of the few investment assets that can be owned anonymously. If you wish, no one has to know about it. |

| 5 | Gold is liquid and portable | Gold is easy to carry and exchange for another currency! |

| 6 | Gold is easy to store and has low maintenance and upkeep costs. | Storing gold doesn't require much space or maintenance and upkeep costs. You can keep it at home if you wish. |

| 7 | Gold does not require special expertise or knowledge. | You do not need special expertise or knowledge to buy gold. |

| 8 | Gold can protect against bad politics. | It is a good idea to keep part of your wealth outside the banking system and political influence. |

| 9 | Gold protects the stock market. | If you want an asset whose price rises while others fall, gold is more likely to do just that. The more stocks you own, the more gold you need. |

| 10 | Gold protects your investment portfolio during crises. | Gold is like a safe haven. Due to the uncertainty of today's economy and monetary system, gold also offers a tremendous return opportunity. |