Pioneer of the modern gold standard James Turk discusses with an American as a guest on Real Vision about gold and the likelihood of returning to the gold standard. The central question of the discussion is whether gold will again become a global currency at some point in the future.

James Turk studied at the Austrian School of Economics and spent years delving into the latest economic theories, contrary to his university's teachings. In university education, gold was considered a 'barbarous relic.' He became convinced of the idea that gold will someday circulate again as a global medium of exchange. He believes that J.P. Morgan himself made a good conclusion about the importance of gold before Congress in 1912 when he said, 'money is gold, nothing else.”.

While working early in his career at Chase Manhattan Bank, James's perspective on gold further changed; he learned from colleagues who had lived and worked through the Great Depression decades earlier, as well as from his parents, who greatly shaped his views on gold.

Does history repeat itself?

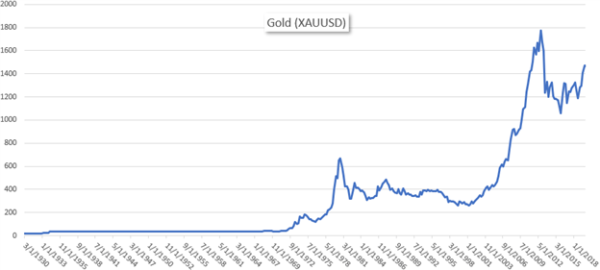

Regarding the Great Depression and the London Gold Pool of the 1960s, James believes that history is repeating itself. The collapse of the London Gold Pool in the late 1960s led to the end of the Bretton Woods system and the collapse of the gold standard. This caused the price of gold to rise above the pegged $35 price, which led to gold confiscations from the U.S. gold reserves.

According to James Turk, this was due to the fact that people understood that fiat money (e.g., paper money or coins) had lost its previous value because it was no longer tied to physical gold. From James's perspective, gold is a way to preserve wealth rather than to grow it over longer periods. He is on the same page as Rick Rule, who believes that gold should be viewed more as insurance or a hedge – not just from a return perspective.

The property of gold as a preserver of purchasing power is achieved through one simple function that James Turk calls "M3"; this is the terrestrial gold supply (i.e., the total amount of gold in circulation that has already been mined from the earth). James Turk argues that the preservation of gold's purchasing power is achieved by M3 growing at 1.75% annually. This figure is consistent with wealth growth and global population growth.

So, will the markets return to a gold standard in some form? Time will tell.

This article is a summarized translation of the original English article “A Return to the Gold Standard Could be Right Around the Corner”.

Image and original article: DailyFX

Video production Real Vision©

READ ALSO:

Gold as a safe haven: is it time to take profits or increase holdings?

Gold and silver in a bull market – comparing to historical upswings