Gold Helps Preserve Wealth in the Past and in 2024

Gold Switzerland: Catch the Goldwagon or Lose Your Fortune

In his article, Egon Von Greyerz, the author of Gold Switzerland, paints a bleak picture of the state of the dollar-based monetary system and warns of the imminent risk of collapse. The article blames the U.S. government for poor economic management and warns those who are not prepared to face the consequences.

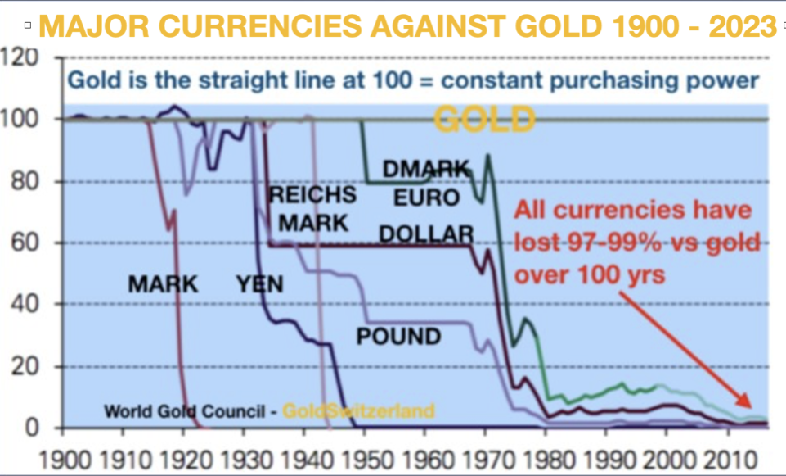

The article emphasizes the author’s strong recommendation of gold as the last safety net in economic uncertainty. Greyerz examines history and shows that physical gold is an age-old winner in preserving wealth. In particular, he emphasizes its significant role in the collapse of various currencies and fiat monetary systems.

The article criticizes the recent proposal to confiscate $300 billion from Russia’s reserves for the reconstruction of Ukraine. The author considers this move to be short-sighted and warns of possible consequences, such as global political and civil unrest. Greyerz bases his critical perspective on a broader historical review and specifically on situations in which the United States has been seen as the initiator of conflicts. He questions the ethical justifications of these.

In addition to geopolitical complexities, the article delves into the world of energy economics, claiming that the world is struggling with an impending energy crisis. It questions the efficiency of renewable energy sources and challenges the prevailing view of electric cars from the perspective of the environmental impacts of battery production and disposal. The article explores the economic consequences of an energy deficit, such as a decline in wealth due to declining energy resources.

The author also contemplates and predicts the future role of BRICS countries as the Western empire weakens, but he still considers China’s massive debt problem to be a potential obstacle to the rise of BRICS countries.

In the end, Greyerz encourages the reader to take action and jump on the “gold bandwagon.” He presents gold as a lifeline in the impending economic storm. He also emphasizes the urgency of the matter from an individual perspective: with gold and partly also silver, an individual can secure their financial situation.

Hubbis: Gold in 2024 – Surprising Trends and Resilience

Hubbis (Helping Asian Wealth Management Communities Interact) predicts the development of gold in 2024. According to the article, the price of gold has traditionally been expected to fall when interest rates rise, but gold has exceeded expectations by maintaining record levels of around $2,000 per ounce over the past 18 months.

The historical relationship between gold and the real returns on bonds changed after the 2008 global financial crisis, when quantitative easing raised concerns about monetary debasement and boosted gold’s appeal.

Over the past 15 years, gold and real interest rates were closely linked, but there has been a divergence in recent times, according to Hubbis. The normalization of US Federal Reserve (Fed) monetary policy, which includes balance sheet reduction and interest rate hikes, led to a significant drop in the amount of physical gold ounces held in Western ETFs.

Demand for gold bars and coins in Europe, especially in Germany, also fell, and the sentiment on the gold market froze, the article says. However, another strong source of demand, central bank demand following the Russia-Ukraine conflict, offset these negative price pressures.

However, real interest rates began to accelerate in early 2022, at the same time as the gold price and real interest rate levels diverged. Central bank demand, especially due to geopolitical events, is significant in this regard, Hubbis suggests. In addition to central banks, China and the Middle East have seen record demand for gold bars and coins, which is a significant change from previous years.

Based on these factors, Hubbis suggests that gold is showing unexpected resilience in 2024 amid rising interest rates and geopolitical tensions. They argue that the changing central bank demand and global demand patterns are changing the traditional dynamics of gold.

Summary

The two articles offer a mixed view of the future of gold. Greyerz is highly bullish on gold, arguing that it is a safe haven asset that will continue to appreciate in value in the face of economic uncertainty and geopolitical instability. Hubbis is more cautious, but he still believes that gold is likely to remain a valuable asset in 2024.

Here are some of the key points from the two articles:

* Gold has defied expectations by maintaining record prices even as interest rates have risen.

* Central bank demand for gold is a key driver of its price.

* Geopolitical instability is also a factor driving demand for gold.

It remains to be seen how the gold market will perform in 2024.

This article is compiled paraphrasing the content of the original two articles. They don’t necessarily represent Jalonom’s views and the content is not intended to be used as an investment advice.

If you’re interested in buying gold online, Jalonom offers a variety of gold products, providing a convenient and secure method to acquire this precious metal.